There is no true way to know exactly how prices will change once all the embedded taxes in the current system are removed. Dr. Jorgenson calculated that currently, if a product costs $100, $22 of that is due to taxes upon the multiple producers involved in the creation of the product. The FairTax removes all of those taxes. It also removes all the withholding taxes that currently burden every paycheck (7.65% minimum from the employee, approximately 10.5% from the employer). Every business will handle this windfall differently: some will pay their employees the 7.65% and keep the 10.5% for themselves; others will lump their 10.5% into more employee pay to attract higher-skilled workers; and still others will pay their employees what their employees currently take home, trying to hold on to every dollar possible; and still others will fall in-between. So employee wages will vary greatly.

On the business side, some businesses will take their tax savings and cut their prices to grab a larger market share; others will keep their prices the same and try to pocket the additional earnings; and still others will settle in between these two extremes. What is known is this: the tax burden — and the burdensome reporting and submission requirements from the government — will go away with the FairTax, making it easier for businesses (especially small businesses) to start up and thrive.

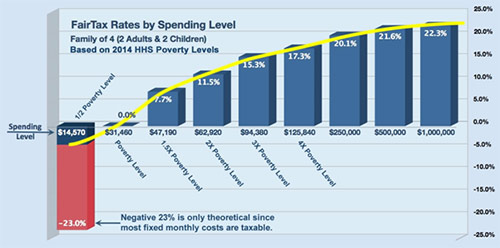

Taking all of that into account, the net result will be, overall, a population with more money in their pockets at the end of the month, and products that are a little bit less expensive on the shelf. To what degree is unknown. When you take the middle range, however, it can be estimated that on average, employees will gain about half of their 18.35% payroll tax windfall, and businesses will drop their prices about half of their 22% tax windfall (at least until a competitor lowers prices!). Therefore, assuming these averages and the absence of any price competition between businesses (which is unlikely), the net gain in purchasing power would be about 20.2%. And, as a family of four would pay no taxes until they exceed the “poverty level” of spending, a family of four would have to spend in excess of $250,000 before they would pay a higher tax rate than the increase in their spending power. See the chart below.